Health Insurance for Gig Workers

According to a recent report, 80% of uninsured gig workers don’t think they can afford health insurance.

But under the American Rescue Plan Act (ARPA),

4 out of 5 enrollees are able to find health insurance costing less than $10 per month.

The survey, conducted in July 2021, polled nearly 3,000 independent contractors and gig workers and found that:

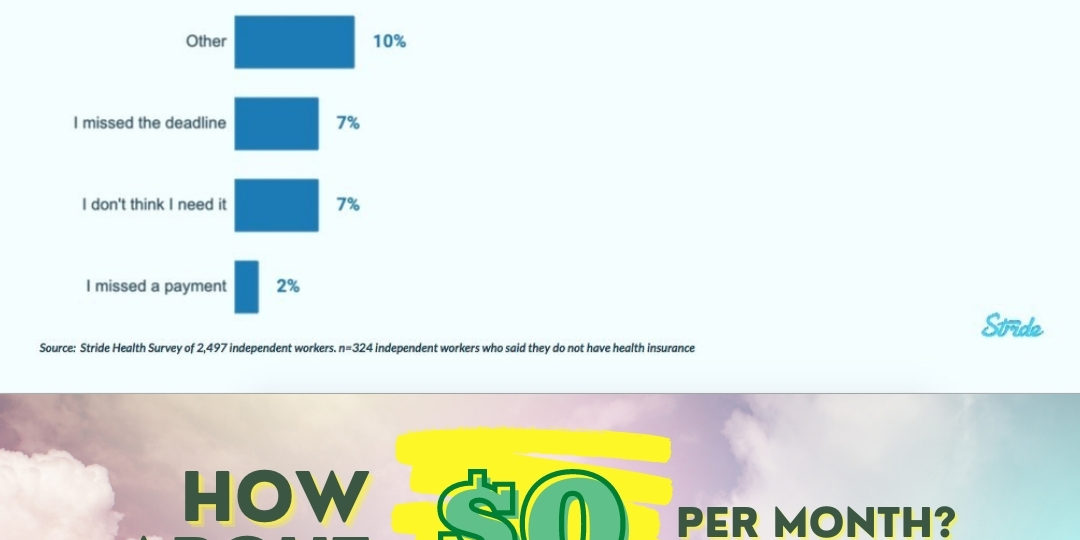

- 31% lacked health insurance

- Of the uninsured, 64% percent cited affordability concerns as the primary reason

- Of those uninsured who believed they couldn’t afford health care, 78% were unaware that 4 out of 5 Americans are now eligible for ACA coverage costing less than $10 a month.

From now until August 15, 2021, there is affordable health insurance for gig workers.

If you know someone who works with Uber, Doordash, Instacart, Amazon Flex, Grubhub who does NOT have health insurance, I can provide them with a free, no obligation consultation.

Many people have started their own businesses or otherwise don’t have access to health insurance through an employer. People like: photographers, makeup artists, models, actors. And there are freelancers of all types: housekeepers, barbers, stylists– all those folks who do good work– but don’t have easy access to affordable health care.

I help Texans review their options, and decide on a plan.

So they can relax, and have peace of mind, knowing they have affordable, high quality health insurance.

The report also reveals that nearly 40% of gig workers who have enrolled in health insurance this year were paying less than $1 per month. And 7 out of 10 were enrolling in better plans at half the cost.

My own plan went from $129 per month last year to $0 per month this year. That’s affordable!

Everyone deserves good health insurance. And everyone deserves to be covered.

For a free, no obligation health insurance consultation, schedule a call here: https://calendly.com/danieloconnell